2020 Board of Review Appeal

2020 Board of Review appeals

Hello Niles Township 12/6/2020

OK. This can be confusing – so buckle in.

The Cook County Assessor 2020 assessed value appeal decisions are in the mail. Do not worry if you have not received your decision yet. The paper regular mail letter will arrive within a week or so. We do not need the actual paper letter for what I want to discuss here. (Also, the appeal decisions are accessible right now at CookCountyAssessor.com anyway.)

Not every appeal will result in a reduction in assessed value. That is perfectly OK. If everyone were to receive a reduction then in essence the total property value for the taxing district is reduced, and the tax rate is therefore increased, and the tax bill remains the same. In short, a taxpayer wants her property value lower relative to other properties in the taxing district.

Now the confusing part. We have two totally different property value issues to discuss: appeals, and, Covid 19. And we need to keep them separate from each other.

One, the appeal results. Some properties received assessed value reductions. Some did not. This is OK. It is the way it has always been.

But – we have a second issue here. The County has applied a Covid 19 reduction factor to property values. Assume (because I am not going to individually confirm that each of many thousands of parcels has received the Covid 19 reduction) that all of the residential properties in the Township have been lowered pursuant to application of a Covid 19 reduction factor. (As I write this note, the appeal results letters that I am seeing do not state that the Covid 19 factor has been applied, or show the resulting Covid reduced value. But you can see the Covid reduced number on the wesite. More on this below.)

When viewed from a residential property, only, perspective, a Covid 19 reduction in assessed value is not going to result in a corresponding tax bill reduction. Remember, to lower the values of the entire taxing district results in a lower total property value, which results in a higher tax rate, which results in the same tax bill as before.

Here is another issue – lower all of the residential values, and none of the commercial values, and we have a shift of tax burden from residential to commercial.

And, likewise, lower the commercial values relative to the residential values and you can expect a tax burden shift from commercial to residential.

I do not know the commercial Covid 19 adjustment factor(s). I know the residential Covid 19 factor is 10% – plus or minus.

Allow me to give you some hints for determining your values:

Here is a screen shot of the CookCountyAssessor.com property search page:

Enter your PIN or your address to call up your property data.

Here is just the relevant section of pull down menus that your search will show:

Go ahead and expand the appeal section:

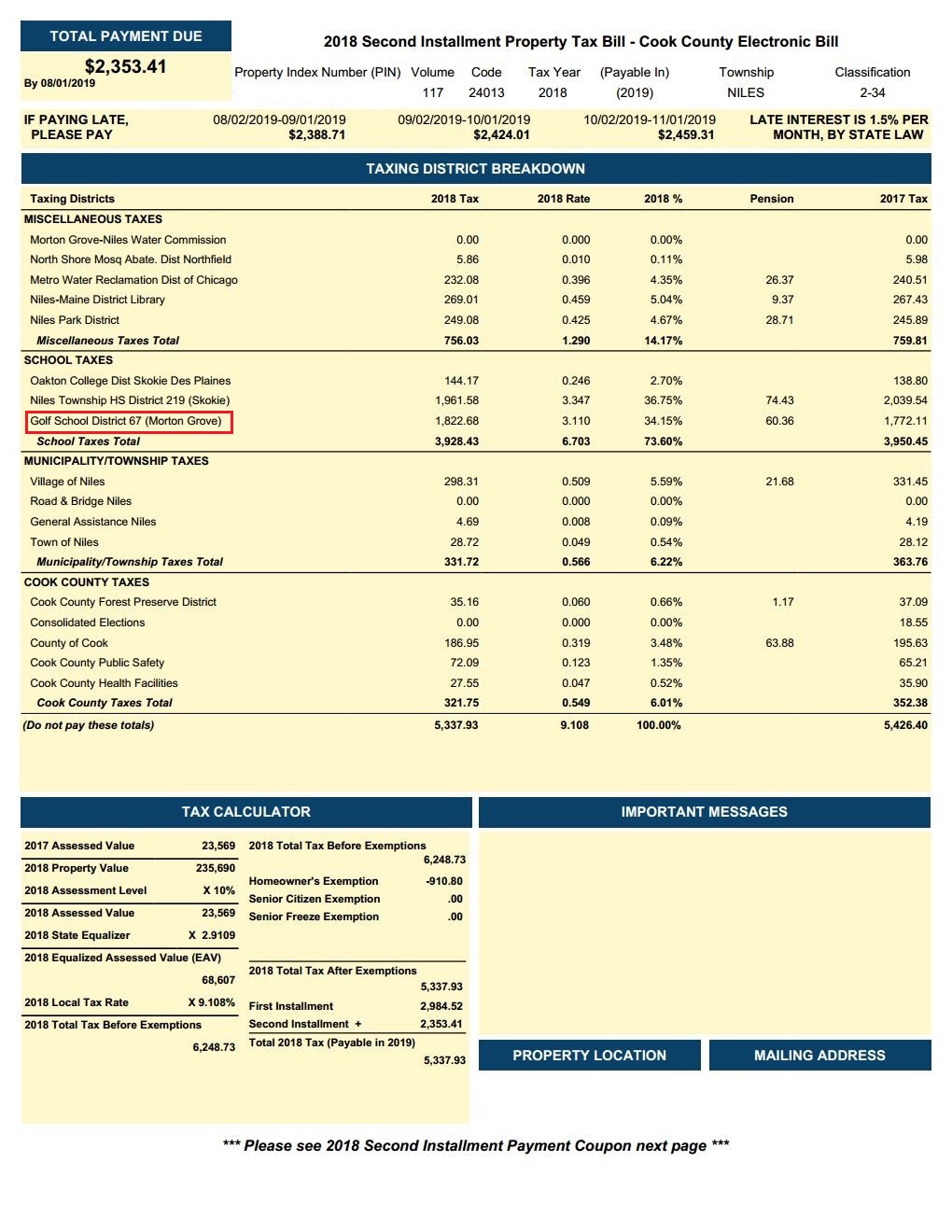

In this example the taxpayer did receive a reduced assessed value on appeal, from $34,987 to $32,657.

So we know that for this tax payer the new assessed value number (BEFORE APPLICATION OF THE COVID 19 FACTOR) is $32,657 which represents a 6.66 % reduction.

Now we are done with the appeal pull down. Close the appeal pull down and open the assessed valuation pull down. On this screen shot of the pull down we see that pursuant to application of the Covid 19 reduction factor the new assessed value is $29,158. (I get it that it does not necessarily say “this is your new value after application of a Covid 19 fact reduction” so it will work out best if you can believe that I am an OK guesser.)

Ahh – you have noticed that on this pull down menu we see a 2019 value of $34,987, not the 2020 appeal value of $32,657.

Here is how I have been checking whether the Covid 19 factor was applied before, or after, the appeal result. I know that the general Covid 19 factor is around 10%. So I use the $32,657 appeal result and calculate that the Covid derived value is close to 10%

[32,657 – 29,158/32,657 = 10.7%]

[If I were to use the 2019 value then I would see

34,987-29,158/34,987=16.6%. So I am confident that the County made a Covid factor reduction of around 10% after the appeal. That way the taxpayer does not lose the benefit of the appeal.]

So what are we going to do?

Well – we are going to appeal.

Eventually, maybe 4 weeks, the Board of Review will open for appeals for Niles Township.

I am going to tell you right now that everyone needs to be thinking about filing that Board of Review appeal.

If the County did not lower your assessed value – appeal anyway if for no other reason than that comparable values might have changed.

If the County did lower your assessed value – appeal anyway for the same reason. The comparable values might have changed.

If you are OK with the Covid 19 reduction, appeal anyway because if everyone received the Covid 19 reduction then you cannot count on that helping your tax bill. Sorry but that is just the way it is.

So now let me give you an initial idea of how my office intends to assist and aid the Niles Township taxpayers in view of what we in the office anticipate will be continuing Covid 19.

- Virtually everything we do, for the immediate future at least, will be by email. Everyone is going to have to really do their best to get an email address. Folks who just do not have the ability to get an email address can have anyone, really anyone at all, register their email address instead. If you have a 8 year old granddaughter living on the moon you can use her email address as long as she promises to call you on the moon phone to tell you what is going on.

- If it is a matter of the taxpayer not wanting to give us their email address, and this does happen, then we prefer that the taxpayer get a second email that they use just for the taxpayer matters. We do not want to burn up additional resources to accommodate someone who simply does not want to give us their email address.

- Please understand that when we are busy, like we will be during the Board of Review appeal time, telephone calls require us to expend way more resources than does email. So, again, please make every effort to get an email address in place. You can start now so that you are ready when the time comes.

- Register at least one email address on our website at NilesTownshipAssessor.com so that you can receive notices and updates.

- As always, every single Niles Township Property taxpayer is going to receive assistance appropriate to need, considering our available resources, and the Covid 19 problem.

- Our next step, property tax wise, is to file 2020 assessed value appeals to the Cook County Board of Review. The Board of Review has something they call pre filing. I do not recommend this procedure. It has led to additional confusion in the past.

- Appeals require supporting evidence. For the most part, at this stage, that evidence consists of comparables. A comparable is a similar property, of similar market value, in a similar area, that has a lower value than the subject property. In short, everyone who wants us to do a comparable search for the 2020 Board of Review appeals will receive comparables from us in one form or another.

- We see three categories of Board of Review appeal filers.

- The DIYers. Those who wish to file on their own directly with the Board of Review. We will send comparables to the DIYers that we find through our research. We do not have the resources to check and analyze comparables that taxpayers come up with on their own. DIYers can select which comparables they wish to file as evidence.

- A second category is taxpayers who will fill out a form (we have not yet built that form but will do so in plenty of time) and have us do the Board of Review filing for them. The great majority of Township taxpayers will fit into this category. We will make this procedure as painless and easy as is possible. Again, my deputy and I will make sure that no Niles Township property taxpayer is left behind.

- The third (very small) group of tax payers do not have email (or an 8 year old granddaughter on the moon).

Scott Bagnall

Julie Oh

NilesTownshipAssessor.com

The Cook County’s Assessor’s Office is responsible for valuing the more than 1.3 million residential parcels in Cook County. Cook County is divided into three assessment districts (City, North

The Cook County’s Assessor’s Office is responsible for valuing the more than 1.3 million residential parcels in Cook County. Cook County is divided into three assessment districts (City, North